What is the Difference Between Excise Invoice and Commercial Invoice?

- 19 Nov 25

- 6 mins

What is the Difference Between Excise Invoice and Commercial Invoice?

Key Takeaways

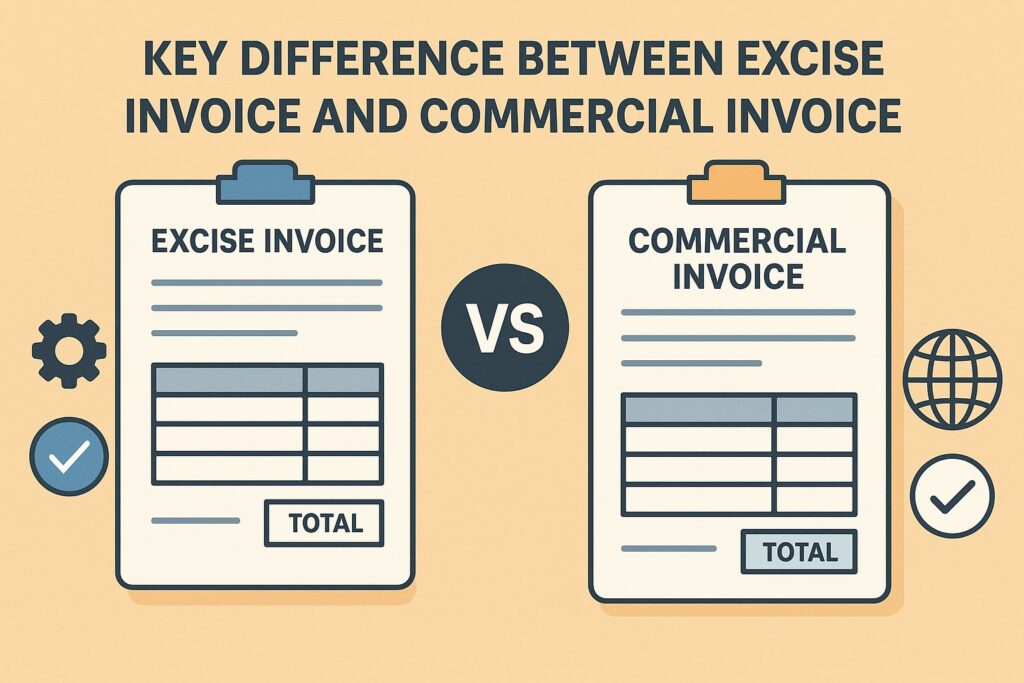

- The difference between excise invoice and commercial invoice lies mainly in their purpose. Excise invoices handle excise duty, while commercial invoices support trade and customs clearance.

- An excise invoice records tax liability on manufactured goods, whereas a commercial invoice acts as proof of sale for international transactions.

- The difference between excise invoice and commercial invoice also appears in audits. Excise invoices support external audits, while commercial invoices aid internal reviews.

- Excise invoices improve transparency in duty calculations, while commercial invoices streamline export–import documentation.

- Understanding the difference between excise invoice and commercial invoice helps businesses avoid compliance errors and maintain accurate transaction records.

It is common for businesses to mix up invoice types while managing transactions and tax records. One such confusion is between excise and commercial invoice, which may seem similar but serve different purposes.

Do you also get confused between the two? They might both deal with recordkeeping of tax liabilities and sales of goods, but there is a vast difference between excise invoice and commercial invoice. Read on to know more about them.

Key Difference Between Excise Invoice and Commercial Invoice

| Key Aspects | Excise Invoice | Commercial Invoice |

| Purpose and Usage | An excise invoice is a necessary trading and tax document that sellers issue when selling goods which levy excise duty. | It is a necessary document for both the export process and import clearance (international shipping). |

| Implications for Businesses | Helps businesses maintain accurate payments, trade logistics, tax liabilities, credit records, payments. | It serves as a contract and proof of sale for businesses engaged in international trade. |

| Operational Efficiency | A clear outline of excise components enhances clarity of the transaction between buyer and seller. | Streamlines daily operations, business transactions, cash flow and helps claim input tax credit |

| Audit and Reporting | Excise invoice helps with external audit and reporting. | Mainly used for internal audits and reporting, for business-related transactions |

Format of Excise Invoice

An excise sales invoice contains all of the necessary details of the transaction. However, the exact format may vary based on location and industry.

- Header Information - It includes information like name, contact details and address of the buyer and supplier and the excise registration number. The header also has details of the invoice number and date.

- Product Details - Goods description is mentioned in the excise tax invoice, along with the number of units, unit price and total price.

- Applicable Taxes and Duties - The excise invoice has details of excise duty along with any other additional taxes that might be incurred.

- Total Amount - It includes the subtotal and total of goods, including duties and taxes.

- Terms of Payment - This refers to the terms and conditions agreed upon by both parties during the agreement. It contains details such as the due date of payment, late payment penalties, applicable discounts, accepted payment methods for excise sales, etc.

Format of Commercial Invoice

While there is no universally agreed format of commercial invoices, there are certain key pieces of information that are included in them. Its format is quite similar to a proforma invoice. Let's find out the official contents:

- Buyer and Seller Details - A commercial invoice format contains details like business logo, business name, company letterhead phone number, street address, tax-identification number of both the buyer and the seller and other tax details.

- Invoice Number and Date - Every invoice has a unique invoice ID, which keeps documents well-organised and helps avoid any duplicate payments.

- Information on the Products and Shipping - For instance, a commercial invoice contains information such as the product name, its brief description, country of origin, quantity, unit price, total price and subtotal. One must ensure that all the details align with purchase order and shipping documents.

- Harmonised System Code - A harmonised system code (HS code) aids in categorising products sent across international borders based on their purpose, type and nature.

- Terms of Sale - The terms of sale and delivery are essential and facilitate trade. It also helps decide whether any additional duties are applicable.

- Payment Terms - These terms let a buyer know how much time they have to make their invoice payment.

After preparing the invoice, sellers need to share it with the buyer and other relevant parties, such as customs officials or freight forwarders.

Which Invoice is More Related to Sales Distribution?

A commercial invoice, often confused with a packing list, is more related to sales and distribution. They serve as proof of payment and facilitate customs clearance. This record of a business deal is important to avoid any legal penalties.

Do Sales and Distribution Units Need to Work on the Excise Invoice?

According to the Indian tax system, a 16% excise duty is payable on the value of manufactured goods or simply on the manufacturing unit value. There is a requirement for sales and distribution units to submit excise duty on a fortnightly/monthly basis. The RG 23C and RG 23A registers help maintain the sales documentation of every excisable good that is purchased.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

Conclusion

Now that you know about the difference between excise invoice and commercial invoice, you can better maintain the business analytics related to transactional records concerning manufactured goods and services. Having invoices can also provide proof of import and export transactions.

By

By